Table of Contents

For any company that takes payments, protecting cardholder information is essential. By paying attention to important security guidelines, such as encryption, access limits, and frequent vulnerability testing, this PCI DSS Compliance Checklist assists you in protecting your payment systems. By taking these crucial actions, you can guarantee compliance, lower the risk of fraud, and protect consumer trust. Let’s begin! Make sure you follow this crucial PCI DSS checklist to safeguard your company and clients. Remain compliant, lower your risks, and confidently execute payments.

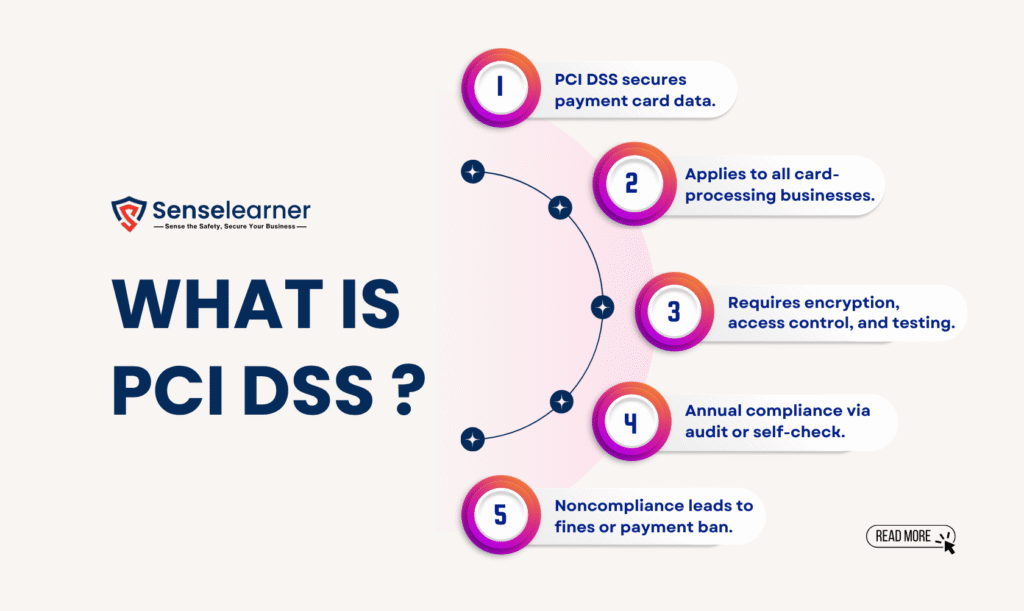

What is PCI DSS ?

A global security standard called PCI DSS (Payment Card Industry Data Security Standard) was developed by major card companies to safeguard payment information. Security measures including data encryption, access limits, and frequent system testing are necessary for every company that processes credit or debit card transactions. Compliance helps keep customers’ trust, prevent fraud, and avoid expensive fines. Annual validation via audits or self-evaluations is required. Penalties or the inability to process payments are the consequences of noncompliance.

PCI DSS Compliance levels and requirements

The number of card transactions a company processes annually determines its PCI DSS compliance level. The most stringent checks—annual audits and quarterly scans—are necessary for Level 1 transactions (6 million or more). Simpler scans and self-assessments (SAQs) are required for Levels 2-4 (fewer transactions).

The fundamentals of PCI DSS v4.0’s essential principles include the use of firewalls, strong passwords, antivirus software, limited access controls, activity monitoring, encryption for sent and stored data (TLS 1.2+), and frequent security testing. While large processors are subject to stricter regulations, smaller companies are subject to less stringent ones.

Read More cyber-risk-management/pci-dss-compliance

Common PCI DSS Compliance gaps

A common security flaw is the reason why many companies fail PCI DSS examinations. These include inadequate multi-factor authentication (MFA), shared admin logins, and overly broad employee permissions, among other weak access controls. Unencrypted data storage is another significant problem, including the unlawful keeping of CVV numbers and the use of antiquated encryption (e.g., SSL instead of TLS). Last but not least, unpatched security vulnerabilities and neglected quarterly vulnerability scans also result in noncompliance. Closing these loopholes is essential to passing audits and safeguarding client information.

PCI DSS checklist for Compliance

The first step in maintaining PCI DSS compliance is to secure your network using firewalls, WAFs, and appropriate segmentation to separate payment systems. By using robust encryption (TLS for transfers, AES-256 for storage) and never keeping private information like CVV numbers, you can safeguard cardholder data. Strengthen access controls by requiring MFA for all users and implementing role-based permissions. Lastly, to find and fix security flaws, perform vulnerability checks every three months. By following this checklist, you can maintain your company compliant with little risk and help prevent breaches.

Best practices for Maintaining Compliance

It takes professional supervision and aggressive security measures to maintain PCI DSS compliance. Beginning with intrusion detection systems (IDS) to promptly discover threats, automate security monitoring using SIEM technologies such as Splunk or Wazuh for real-time warnings. Prior to your official assessment, conducting practice audits can help identify and fix any compliance issues. Working with a Qualified Security Assessor (QSA) also results in certified compliance documents, correct validation, and the avoidance of self-assessment errors. In addition to improving your security posture, these best practices expedite the compliance procedure, lowering risks and possible penalties.

How Senselearner’s PCI DSS Audit services help

Senselearner’s PCI DSS Audit Services offer a comprehensive security solution that simplifies compliance. In addition to helping with SAQ and ROC documentation, their professionals carry out penetration testing to reveal actual risks and gap analysis to find vulnerabilities. Along with ongoing monitoring to guarantee long-term compliance, they also offer remediation support to address vulnerabilities. By enhancing their security posture, companies may effectively obtain and sustain PCI DSS certification with Senselearner.

Beyond compliance Building lasting security with Senselearner

Senselearner PCI DSS compliance service helps companies safely handle payment data, which makes PCI DSS compliance easier. We help firms with vulnerability scanning, gap assessments, and necessary documentation such as SAQs while putting in place the fundamental security controls—firewalls, encryption, and access management. Through secure payment processing, our customized strategy guarantees that all businesses—from tiny retailers to major corporations—meet PCI DSS v4.0 standards, lower fraud risks, and gain the trust of their clients.

Also read how-to-perform-firewall-audit

Why compliance never ends ?

PCI DSS compliance is a continuous necessity due to the constant nature of cyber risks. Your security measures must be updated often to secure sensitive payment information as hackers create new ways to attack. Digital dangers are ever-changing, so security measures put in place yesterday might not prevent breaches that occur today. A strong defense requires frequent vulnerability assessments, policy revisions, and employee training. In a constantly shifting danger landscape, companies can retain customer trust, avoid expensive fines, and safeguard their reputation by approaching compliance as an ongoing process rather than a one-time endeavor. In this digital environment, the only successful strategy is proactive, ongoing protection.

One thought on “PCI DSS Compliance: Secure Your Payment Systems”